Once the exclusive domain of geologists and reservoir engineers, underground simulation modelling is quickly becoming a must-have for the C-suite working in the energy industry.

From a carbon sequestration perspective, modelling the subsurface is the fastest and cheapest way to de-risk a project, revealing where, how, and the amount of carbon that can be stored in various reservoirs.

“Now that we’re starting to tie economics into a lot of this modeling, it becomes a business issue and not just a technical one,” says Don McClatchie, regional director of Canada for Computer Modelling Group (CMG), a global technology and consulting company focused on reservoir and production simulation and research and development.

CFOs use financial models to steer business decisions toward positive outcomes; business models are used in mergers and acquisitions and for net asset value modelling; and simulation software is increasingly being used by the c-suite within energy companies to assess risk and predict financial outcomes around carbon capture and storage (CCS).

“You can run different scenarios on the computer without actually having to spend money in the real world,” says McClatchie. “You can do trial and error, you can figure out what works, what won’t work, and you can understand the uncertainty around the project without actually having to spend money in the field.”

The economic case has been made for removing carbon at scale, and a groundswell of companies are using CMG’s simulation software to explore energy transition — more than 600 oil and gas companies and consulting firms in 61 countries use the company’s reservoir simulation tools.

With the energy transition to a low-carbon future, energy players are turning their attention to CCS which is often uncharted territory, McClatchie says.

“Many energy companies are thinking about CCS for the first time, and many have no idea how to calculate the business risk or even how to go about putting CO₂ in the ground.”

McClatchie, who is a petroleum engineer by trade, says CCS requires a totally different set of questions to be asked in order to model opportunity and risk.

“Companies are questioning all aspects of a project. How much CO₂ can I put in the ground? How many wells do I need? Where am I going to put them? How do I know it will stay where I want it? How much is it going to cost me?”

Cost of Carbon

The driving force behind the CCS opportunity is the price on carbon pollution and the hefty financial risk of failure to manage the liability.

In Canada alone, the tax on carbon pollution more than doubled from a national minimum of $20 per tonne in 2019, to $50 a tonne by 2022. Under the Greenhouse Gas Pollution Pricing Act, the price rose again to a minimum of $65 per tonne on January 1, 2023 and will grow to a whopping $170 per tonne by 2030.

Pathways Alliance says its planned CCS network is expected to reduce carbon dioxide emissions by 22 million tonnes per year by 2040 (or about 60,000 tonnes per day). If carbon costs $170 per tonne, simple math shows that the network will save about $16.5-billion over nearly four-and-a-half years — the equivalent of the expected cost to build the CCS network to begin with.

In some countries there is the opportunity to turn a liability into an asset, as well. In the United States, the Inflation Reduction Act (IRA) offers government subsidies — not taxation — of up to $85 per tonne of CO₂ permanently stored. So producers are incentivized to invest in CCS beyond tax avoidance.

“All of a sudden, there’s money involved,” says McClatchie. “There’s definitely a monetary aspect and energy leaders are assessing all scenarios around getting the most amount of carbon into the ground at the lowest cost. Modelling is about optimizing the entirety of this process.”

Innovation and Incentives

The pricing approach to carbon is designed to offer incentives for businesses to develop and adopt new low-carbon products, processes and services.

Aquifers — and in particular saline aquifers — are emerging as the innovative, new place to store carbon.

Saline aquifers are arguably better than depleted natural gas reserves because the salty waters in these massive bodies dissolve the carbon, whereas depleted wells simply store it. The challenge is that CO₂ remains in gas form in a depleted gas reserve, which is more problematic because it can more easily move around, thus increasing risk of leakage.

“It’s an area that’s a little less understood from a geology perspective, because up until now, nobody cared about an aquifer because it had nothing profitable in it,” says McClatchie. “Now, all-of-a-sudden, it’s a space to put away CO₂.”

Another advantage is size.

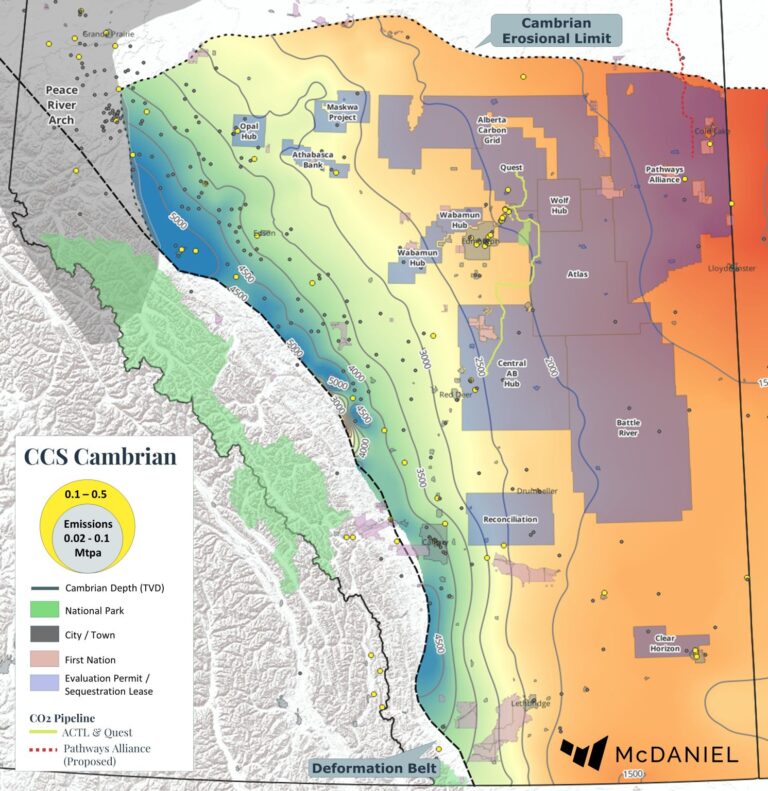

“Aquifers are massive,” says McClatchie. “In Alberta, for example, one of the big aquifers they’re looking at covers nearly half the width of the province from East to West. It’s hundreds of kilometers by hundreds of kilometers. That sheer volume is huge and it’s all water that can’t be used for anything else because it’s salty and not drinkable.”

For oil and gas companies, subsurface simulation software has become a vital tool to understanding this previously uncharted territory of aquifers.

While the interest is huge, so too is the gap in knowledge — particularly around the permeability of aquifers, their porosity, volume, speed of injection, and size required.

“There’s more uncertainty around the geology of saline aquifers than depleted oil and gas wells,” McClatchie says. “But the real story is how leaders are using modelling to de-risk their projects, whether that’s in a depleted oil and gas reservoir or a saline aquifer. We’re entering a totally new era for modeling, risk and opportunity.”

Sign up to receive newsletter updates from Accelerate on LinkedIn.